𝗗𝗲𝗮𝗱𝘄𝗲𝗶𝗴𝗵𝘁 𝗟𝗼𝘀𝘀 𝗮𝗻𝗱 𝗜𝘁𝘀 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗜𝗺𝗽𝗮𝗰𝘁 – 𝗥𝗲𝘀𝘂𝗹𝘁𝗮𝗻𝘁 𝗼𝗳 𝗧𝗿𝗮𝗱𝗲 𝗧𝗮𝗿𝗶𝗳𝗳𝘀

Tariffs do not just shift wealth; they create a net economic loss (i.e. Deadweight Loss) because the reduction in trade leads to lost opportunities, inefficient resource allocation, and higher costs.

Deadweight Loss (DWL) refers to the economic inefficiency that arises when market equilibrium is distorted, leading to a loss of potential trade and productivity.

𝗪𝗵𝗲𝗿𝗲 𝗗𝗼𝗲𝘀 𝗗𝗲𝗮𝗱𝘄𝗲𝗶𝗴𝗵𝘁 𝗟𝗼𝘀𝘀 𝗦𝗵𝗼𝘄 𝗨𝗽?

1. Higher Consumer Prices

– Consumers pay more for goods, leading to a decline in disposable income and lower overall consumption.

– 𝘌𝘹𝘢𝘮𝘱𝘭𝘦: 𝘛𝘩𝘦 2018 𝘜.𝘚. 𝘵𝘢𝘳𝘪𝘧𝘧𝘴 𝘰𝘯 𝘊𝘩𝘪𝘯𝘦𝘴𝘦 𝘨𝘰𝘰𝘥𝘴 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦𝘥 𝘸𝘢𝘴𝘩𝘪𝘯𝘨 𝘮𝘢𝘤𝘩𝘪𝘯𝘦 𝘱𝘳𝘪𝘤𝘦𝘴 𝘣𝘺 12%, 𝘤𝘰𝘴𝘵𝘪𝘯𝘨 𝘜.𝘚. 𝘤𝘰𝘯𝘴𝘶𝘮𝘦𝘳𝘴 $1.5 𝘣𝘪𝘭𝘭𝘪𝘰𝘯 𝘢𝘯𝘯𝘶𝘢𝘭𝘭𝘺.

2. Reduced Trade & Economic Growth

– Trade expands market access, lowers costs, and increases competition.

– Tariffs restrict trade flows, limiting economic output.

– 𝘌𝘹𝘢𝘮𝘱𝘭𝘦: 𝘛𝘩𝘦 𝘚𝘮𝘰𝘰𝘵-𝘏𝘢𝘸𝘭𝘦𝘺 𝘛𝘢𝘳𝘪𝘧𝘧 𝘈𝘤𝘵 (1930) 𝘸𝘰𝘳𝘴𝘦𝘯𝘦𝘥 𝘵𝘩𝘦 𝘎𝘳𝘦𝘢𝘵 𝘋𝘦𝘱𝘳𝘦𝘴𝘴𝘪𝘰𝘯 𝘣𝘺 𝘴𝘭𝘢𝘴𝘩𝘪𝘯𝘨 𝘜.𝘚. 𝘦𝘹𝘱𝘰𝘳𝘵𝘴 𝘣𝘺 61% 𝘥𝘶𝘦 𝘵𝘰 𝘳𝘦𝘵𝘢𝘭𝘪𝘢𝘵𝘰𝘳𝘺 𝘵𝘢𝘳𝘪𝘧𝘧𝘴.

3. Inefficient Domestic Production

– While some industries benefit, tariffs artificially prop up inefficient sectors, misallocating resources.

– 𝘌𝘹𝘢𝘮𝘱𝘭𝘦: 𝘛𝘩𝘦 𝘉𝘶𝘴𝘩 𝘚𝘵𝘦𝘦𝘭 𝘛𝘢𝘳𝘪𝘧𝘧𝘴 (2002) 𝘤𝘢𝘶𝘴𝘦𝘥 𝘴𝘵𝘦𝘦𝘭 𝘱𝘳𝘪𝘤𝘦𝘴 𝘵𝘰 𝘴𝘶𝘳𝘨𝘦, 𝘩𝘶𝘳𝘵𝘪𝘯𝘨 𝘢𝘶𝘵𝘰𝘮𝘢𝘬𝘦𝘳𝘴 𝘢𝘯𝘥 𝘮𝘢𝘯𝘶𝘧𝘢𝘤𝘵𝘶𝘳𝘪𝘯𝘨 𝘫𝘰𝘣𝘴.

4. Retaliation & Trade Wars

– Tariffs often lead to retaliatory measures, further restricting trade.

– 𝘌𝘹𝘢𝘮𝘱𝘭𝘦: 𝘛𝘩𝘦 𝘜.𝘚.-𝘊𝘩𝘪𝘯𝘢 𝘵𝘳𝘢𝘥𝘦 𝘸𝘢𝘳 (2018-2019) 𝘳𝘦𝘴𝘶𝘭𝘵𝘦𝘥 𝘪𝘯 𝘳𝘦𝘵𝘢𝘭𝘪𝘢𝘵𝘰𝘳𝘺 𝘵𝘢𝘳𝘪𝘧𝘧𝘴 𝘰𝘯 𝘜.𝘚. 𝘢𝘨𝘳𝘪𝘤𝘶𝘭𝘵𝘶𝘳𝘦, 𝘢𝘶𝘵𝘰𝘮𝘰𝘣𝘪𝘭𝘦𝘴, 𝘢𝘯𝘥 𝘦𝘭𝘦𝘤𝘵𝘳𝘰𝘯𝘪𝘤𝘴, 𝘭𝘦𝘢𝘥𝘪𝘯𝘨 𝘵𝘰 $28 𝘣𝘪𝘭𝘭𝘪𝘰𝘯 𝘪𝘯 𝘧𝘢𝘳𝘮 𝘴𝘶𝘣𝘴𝘪𝘥𝘪𝘦𝘴 𝘵𝘰 𝘤𝘰𝘶𝘯𝘵𝘦𝘳𝘢𝘤𝘵 𝘭𝘰𝘴𝘴𝘦𝘴.

5. Lower Investment & Market Volatility

– Investors and businesses hate uncertainty.

– Increased tariffs lead to lower capital investment, stock market sell-offs, and reduced GDP growth.

𝗧𝗵𝗲 𝗟𝗼𝗻𝗴-𝗧𝗲𝗿𝗺 𝗖𝗼𝗻𝘀𝗲𝗾𝘂𝗲𝗻𝗰𝗲𝘀 𝗼𝗳 𝗗𝗲𝗮𝗱𝘄𝗲𝗶𝗴𝗵𝘁 𝗟𝗼𝘀𝘀

1. Persistent Inflation → Higher input costs create lasting price hikes.

2. Weakening Global Competitiveness → Domestic industries become reliant on protectionism, reducing efficiency.

3. Slower Job Growth → Retaliatory tariffs lead to layoffs and business closures.

4. Stagflation Risks → Less trade, high prices, and sluggish growth can create a worst-case economic scenario.

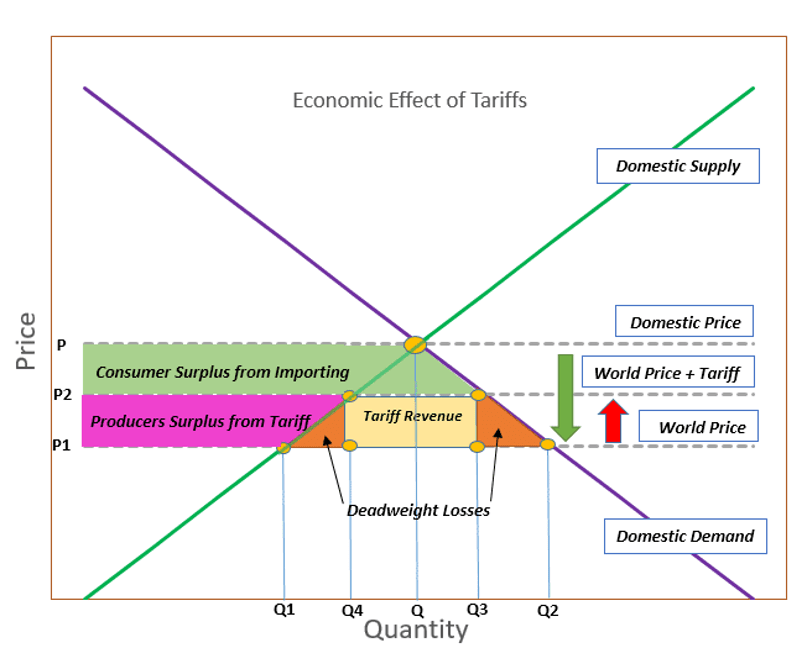

Visualizing Deadweight Loss

(Graph Source: Acropolis Investment Management)

In the delineated graph, assuming the absence of global trade, Q represents the equilibrium quantity within the domestic economy, while P denotes the domestic equilibrium price, excluding transaction costs. With the introduction of global trade, domestic producers are compelled to reduce production to Q1 (lower than Q) and adjust prices downward to P1 to remain competitive against lower-cost imported goods. The decline in prices stimulates domestic consumption, increasing demand from Q to Q2. The excess demand—represented by the difference between Q2 and Q1—is met by foreign producers, effectively bridging the supply-demand gap in the domestic market.

However, with the imposition of tariffs on imports, the price rises from P1 to P2, incentivizing domestic producers to expand output to Q4 while simultaneously constraining consumer demand, reducing it from Q2 to Q3.

While such trade restrictions may contribute to reducing the trade deficit, they also introduce deadweight losses, leading to inefficiencies, reduced trade potential, and a decline in overall economic productivity.

DWL = (½) * (P2 – P1) * (Q1 – Q2)

Where:

• P1 & P2 = Prices before & after intervention

• Q1 & Q2 = Quantities before & after intervention

In a tariff-imposed economy:

- Consumers lose surplus due to higher prices.

- Producers gain a small surplus, but not enough to offset overall losses.

- Government collects tariff revenue, but it doesn’t compensate for the economic shrinkage.

- The shaded triangles on an economic graph represents lost trade and inefficiency—DEADWEIGHT LOSS.

The Bottom Line

Tariffs are more than just a tax on imports; they act as a tax on overall economic growth. By creating deadweight loss, they lead to fewer jobs, reduced productivity, and increased costs for businesses and consumers alike. A more effective trade policy should prioritize economic efficiency over protectionism to foster sustainable growth and competitiveness.